Deciding between single family vs multi-family investments is a significant step for real estate investors. The choice between these types of properties influences not just the returns but also the challenges investors face.

From the complexity of management to the investment’s liquidity and sensitivity, to the market dynamics. Your investment choice will guide the potential for income, price appreciation, and diversification benefits in your portfolio.

So let’s explore the nuances of single-family vs multi-family investments.

The Difference Between Single-Family and Multi-Family Properties

Single-family properties are freestanding residential buildings designed for one family, offering independent living with no shared walls or utilities. SFRs often appeal to families and long-term renters, leading to lower turnover rates and potentially more stable rental income streams. The national median cost to purchase a single-family home is $374,900, with a higher average monthly rent of $2,018.

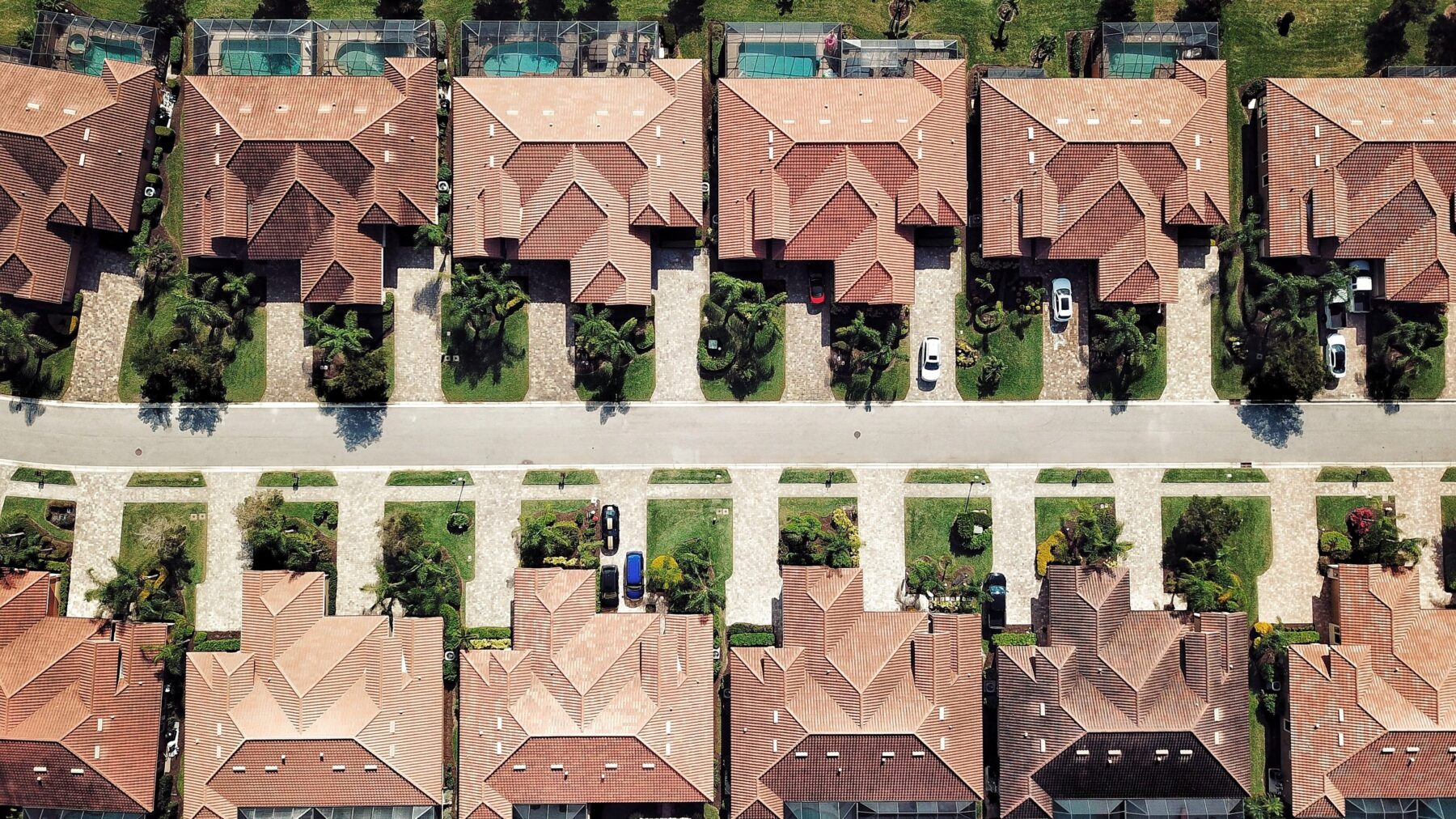

In contrast, multi-family properties consist of multiple separate living units within the same building or complex, such as apartments or duplexes. They are suitable for investors seeking higher income through rental yields and efficient management of multiple tenants under one roof.

Unlike SFRs, multi-family units share common facilities like laundry rooms and utilities, which can limit privacy but simplify some aspects of property management.

Per unit, multi-family homes are generally less expensive than SFRs. This distinction allows for a higher potential rental income because of their multiple-unit structure. The average monthly rent for these properties is $1,659, with notable year-over-year increases.

MFRs typically have higher turnover but can attract a broader range of tenants, from singles to small families, which can fill vacancies more quickly.

SFR vs. Multi-Family Properties

As a real estate investor, it’s important to consider your investment options. This can inevitably lead to the question: should you invest in SFR or multi-family real estate? The choice largely depends on your investment strategy, yet it’s worth noting that the most profitable portfolios often diversify across various types of investments.

So, let’s delve into what it would mean to invest in SFR or multi-family properties:

- Financing: In the real estate industry, larger properties generally come with higher price tags. Compared to single-family houses, multifamily properties require significantly higher initial capital. However, multifamily investments generally qualify for better financing terms and economies of scale. This makes them attractive for investors looking to scale quickly by acquiring properties with 100+ units.

- Profitability and Access: Although multifamily properties are more expensive to acquire, they hold the promise of greater profit margins. It’s essential to remember that both property types can generate steady income streams with proper management.

- Control and Flexibility: Single-family home rentals offer more control over property management and tenant quality. However, multi-family real estate offers a unique advantage – the option to occupy one of the units yourself. This arrangement is commonly seen in duplexes. In this case, the investor resides in one unit while renting out the other, which might appeal to those looking for a balance between investment and personal use.

- Market Demand: The current housing market shows a rising demand for single-family homes. However, multifamily properties have historically experienced stable demand. The differences in the demand between these two types of properties will depend on various trends in the specific market.

- Property Management Considerations: SFR properties are generally easier to manage. Multifamily properties may require additional property management and even the involvement of an external vendor. This can potentially impact your expenses.

Both SFR and multi-family real estate properties offer attractive opportunities for investors. However, it’s crucial to have a good understanding of the options you have in the real estate market when making an informed decision that aligns with your long-term investment goals.

SFR or MFR? Which One to Choose?

To achieve your specific investment goals, it’s crucial to carefully assess the properties you’re considering. Here’s a detailed look into key decision-making factors for both SFR and MFR.

Investment Goals and Market Conditions

- Investment Goals: Determine whether your primary aim is capital appreciation, which might favor SFRs, or generating steady cash flow, which MFRs typically provide.

- Market Conditions: Analyze the economic environment and real estate market trends to predict potential future income and property value increases.

Legal and Operational Considerations

- Relevant Laws: Understand the impact of local regulations, which can affect everything from renovation approvals to tenant rights, significantly influencing your operational strategy.

- Property Management Preferences: Decide if you prefer the hands-on approach required for SFRs or if you can handle the complex management and higher tenant turnover rates typically associated with MFRs.

Financial Analysis and Location Assessment

- Costs and Income Evaluation: Calculate the total costs, including potential repairs and renovations, against the expected rental income. This financial assessment helps in determining the viability of the investment.

- Location: Properties close to business hubs, schools, and amenities generally attract more tenants and can command higher rents, impacting your income stream and investment sustainability.

Risk Assessment and Mitigation Strategies

Both SFR and MFR properties are subject to market fluctuations and regulatory changes, which can affect overall investment viability. As we’ve touched up, SFR investments typically involve lower initial capital but can be sensitive to tenant turnover, leading to potential income gaps. Conversely, MFRs, while offering higher potential rental income through multiple units, entail more complex management challenges and higher operational costs.

To mitigate these risks, SFR investors should focus on thorough tenant screening to ensure stability and reduce vacancy periods. Along with that, you should maintain a robust maintenance schedule to uphold property value and appeal. Another way to protect your investment is to insure it. Adequate insurance coverage is critical against unforeseen damages and liabilities.

For those investing in MFRs, employing professional property management solutions can be invaluable in handling the day-to-day operational complexities (like dealing with HOAs for example) and maintaining tenant relations.

Diversifying tenant profiles within the property can also help stabilize rental income streams and minimize the financial impact of unit vacancies. Clear and comprehensive lease agreements tailored to multi-tenant settings will help you safeguard your investment.

Finally, both SFR and MFR investments would benefit from maintaining a reserve fund to manage unexpected expenses or market downturns effectively.

To Wrap it Up

Choosing to invest in single-family or multi-family property depends highly on your financial goals, management preferences, and market conditions.

Single-family residences often appeal to those looking for a straightforward management approach and long-term capital appreciation, while multi-family properties can offer quicker cash flow and opportunities for scale, despite their complexity.

As you consider your next investment, weigh these factors carefully to determine which path will best enhance your portfolio’s performance and sustainability. Whether you lean towards the autonomy of SFRs or the tenant dynamics of MFRs, the key is to stay informed and proactive in your investment strategy to navigate the ever-evolving real estate market successfully.

Looking for more SFR property management tips? Sign up for Rexera’s newsletter. We keep it brief and practical.