We know how important HOA documents are for home closings. However, the process of obtaining these documents can often be complex, time-consuming, and prone to errors. This leads to potential risks, wasted nerves, and additional costs for Sellers, such as rush fees.

Document acquisition and processing services like Rexera exist to make the entire HOA process easier and smoother for Title and Escrow companies, Lawyers, Buyers, Sellers, Lenders, SFR investors, and real estate agents.

Rexera pays for the HOA document fees upfront or and then fronts the fees to the Seller after the closing together with the service fee. Or we will ask the Seller to pay for the document fees upfront, depending on the closing. Discovering the advantages of outsourcing HOA documents reveals that Sellers not only find it convenient and don’t mind paying an additional fee but also appreciate the stress-free closing it ensures.

5 Reasons Why Your Clients Would Prefer You Add an HOA Documents Service Fee

Thinking about using a third-party service raises questions: What would the Seller think of you using a third-party service for something you are capable of doing on your own? Can you pass yet another fee to your client? What if your competition doesn’t add extra fees? These questions matter for your plans of scaling and growth.

Well, what would the Seller say if they have to pay rush fees? Going back and forth with the HOA and the Seller to pay for the fees also takes away the precious time at closing. And as an Escrow Officer, you’ve probably had times when the Seller would provide outdated HOA documents or hide the outstanding HOA fees. This can turn into a future headache for the Buyer.

You can continue juggling everything at once to ensure you avoid rush fees and all the documents are up-to-date. Considering how many moving parts a transaction has, this can be very challenging. An alternative? You can eliminate these risks by outsourcing to the right vendor.

1. Paying For Documents Upfront

Sellers do not like to pay for HOA documents upfront. They often prefer to defer the payment until during or after the closing, once they have received the money for the property. For Sellers, the upfront payment is an additional frustrating burden. This reluctance leads to a delay in the payment and, respectively, a lot of chasing and calls the Escrow Officer has to make to the client. Even worse, it can delay the closing, and no one will be happy then.

Melissa Daniels utilizes third-party vendors to optimize her business processes. Melissa has her own business, Texas Family Title, and puts her trust in Rexera to acquire HOA documents. She sees a lot of value in Rexera paying for HOA fees upfront. In her 30 years at the job, she’s never asked her clients to do it. She prefers to cover the fees herself and then deduct them at closing. It saves her time and adds a more personalized approach to her customer service.

“When a title company reaches out to a Seller asking them to pay for something upfront— it’s always a battle, which makes it feel very transactional.”, says Melissa.

2. Higher Than Average HOA Documents Fee In Texas

In addition to the previous point, Texas presents another complication: the fees are higher than in other states. In Florida, for example, the document fees are capped, while in Texas, the fees can go wild. Not only does the Seller have to pay in advance, they also have to pay much more than the average.

What would the client prefer? We asked our client and the founder of Proven National Title in Texas, Jacki Tobar, for some insights on this. Here is what she said:

“99% of the time, the clients are perfectly fine with the [Rexera] fee and are excited that I found a way to deliver the documents faster.”, says Jacki.

To provide exceptional service to her clients, Jacki partners with third-party services, such as Rexera. Her clients are happy that everything HOA-related is being handled quickly and with no surprises.

3. Making Sure All Documents Are Delivered on Time

You need all documents ready before the closing date. Each HOA has its timelines for issuing the closing documents. After identifying whether you will have to pay rush fees or you are still on time, you will need to nudge the Seller to pay the fees so that you can obtain the documents on time.

Many HOAs are self-managed, which makes it difficult to not only get accurate and updated documents on time but also find the contact information of the HOA board and get through to them. If such cases occur, it’s best to send a person onsite to get the documents, which Rexera has done many times.

On the other hand, if you fail to get all necessary HOA documents on time, you could delay the closing, and the client definitely wouldn’t like that.

4. A Myriad of Community Associations

There are Master associations, co-ops, PUDs, etc. They can be professionally managed or managed by volunteers on the HOA board. How do you keep track? Sellers definitely don’t. They often don’t know whether there is a sub- or a master HOA or other types of community associations tied to the property.

By the time you realize there is another association you need documents from, you might have to do a rush order, which again does not make the Seller happy.

5. Missed, Incomplete, or Inaccurate Information

HOA documents are usually hard-to-read scanned documents. Finding the key closing information in between hundreds of pages is nearly impossible. Missing on some outstanding fees can lead to additional costs for the Buyer and, consequently, the title company.

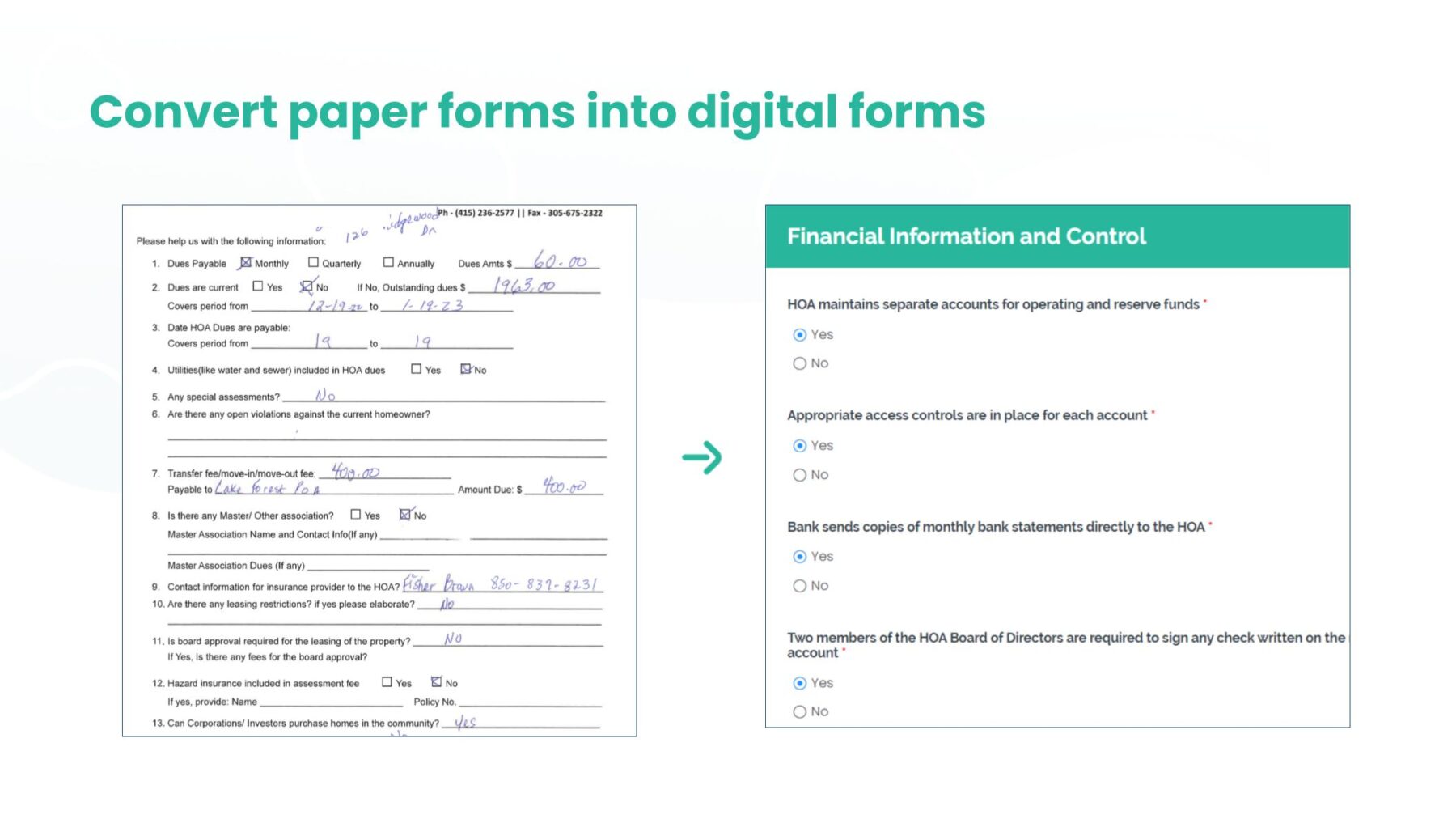

This is where technology and AI come into play. There are document processing services like Rexera that turn your documents into an easy-to-read electronic format. You can quickly search and find the needed information and provide your clients with fast and actionable data.

Following the five cases above, adding an HOA document service fee to your client transforms into a long-term benefit not only to them but also to you. It saves time you would spend on manual tasks and money for your clients, who would pay even bigger fees if parts of your process crumble. Even more, you can go deeper into the details of your HOAs’ financial and operational health. All of it is at your fingertips, while you can focus on building exceptional client relationships.

How to Make Dealing with HOA Fees Easier for Escrow and Their Clients

Would it be nice if someone fronted the fees, brought peace of mind to the Seller, and a smoother closing process for the Escrow Officer? Services like this exist and prove to be useful.

Transcounty used to obtain documents from HOAs on their own and wasted time on back-and-forth communication and manual processes. After partnering with Rexera, they were able to shorten their processing time and remove the friction in their closing process.

“People would rather pay more at closing than pay to the HOA upfront. It makes them think about the fact that they are leaving the HOA, but they have to pay for all these things to get the information.

It’s a much better experience for the client because you don’t have to bother them too much to get the information or get them to get their credit card out to make payments. A lot of people are wary of making payments online.”, shares Christina Sandler, an Escrow Officer at TransCounty.

Proven National Title prefers to outsource some of their time-consuming work to trusted partners, including trusting Rexera with HOA document acquisition. This helps them improve efficiency and focus on providing exceptional customer service.

“I love outsourcing as much as possible. It frees up my time to work with clients. It’s like having an assistant without having to keep someone on payroll.”, shares Jacki about third-party vendors.

According to Jacki, it’s a win-win relationship for both parties, and everyone can focus on what they do best.

Ensuring Smoother Closings

Here’s exactly how Rexera ensures Title and Escrow Companies have a simplified and error-free HOA document retrieval process.

1. Flawless Documents Delivery

Rexera ensures all necessary documents are delivered on time, with no errors or typos. We use technology for document processing and have a stellar title industry experts team who always check for sub- and master-HOAs, order documents on time to avoid rush fees and check the accuracy of the documents every time.

2. Eliminating Friction and Saving Time and Money on Fees

You don’t need to chase the Seller for payment anymore. Rexera takes care of communicating with the HOA, fronting the fees, and reporting directly to you. The Seller does not have to worry about the fees, and they can pay them at closing.

We have a client portal to keep track of deadlines and invoices. This way, you always know when the documents have been ordered and paid for. You can also share the invoice with a detailed cost breakdown with your client so everything is accounted for.

3. Simplifying the Payment Process For Sellers

Rexera offers the service of paying for the HOA documents upfront and then fronting the HOA documents fees to the Seller after the closing.

Apart from that, Rexera provides secure and simple payment methods, depending on each Seller’s preferences. We understand the importance of transparency and ensuring Sellers’ peace of mind when it comes to their finances. That’s why we provide Sellers with detailed cost breakdowns, giving them a clear understanding of how their money is allocated.

We also send regular reminders to keep Sellers on schedule and avoid delays. When the transaction is completed, Title companies get a full set of requested HOA documents and a 0$ invoice from us.

4. Cost-Effective Solution for Sellers

Yes, there is a service fee that you can choose to pass on to your client. Ultimately, this fee becomes an investment that saves the Seller money on rush fees, or financing costs in case you prepay the documents yourself, eliminates the hassle of prepaying the HOA documents, and reduces the risks of mistakes and missed bylaws.

Mistakes in the documents cost much more during the closing process than a document acquisition fee. For example, Wendy Heffery from Homie Title has shared with us an instance where the HOA typed their information incorrectly and had to lose time and money in court:

“We had a property with a lien due to the HOA typing their fee incorrectly on their documents. We had a payoff come over that stated 0.05% of the sales price was the reinvestment fee and it should have been 0.5%. That’s a difference of over $3,000 based on your sales price.”

5. More Business

We all know that the real estate industry is based on personal experience, feedback, and word-of-mouth advertising. Stress-free closing for your client means more referrals and more business for you. Providing a smooth closing experience doesn’t go unnoticed in the industry.

The Takeaway

Acquiring HOA documents in Texas often leads to complications, but services like Rexera aim to ease these challenges for Title and Escrow companies, Buyers, and Sellers.

Instead of burdening Sellers with upfront payments, you can use Rexera to streamline the HOA document acquisition and ensure timely document delivery. In a cost-effective process, you’ll not only enhance client experience but foster a stress-free closing that will ultimately translate into more referrals and business growth for your company.

Simplifying processes and prioritizing client satisfaction can set your business apart. Give it a try.