As an Escrow officer, dealing with HOA documents for closing might seem like a mundane and repetitive task. However, acquiring complete and accurate HOA documentation before closing is crucial. Failing to secure the package of documents can delay or even terminate a real estate closing transaction.

In this article, we’ll discuss the essential HOA documents needed for closing. We will also share tips on how you can improve the process of collecting HOA documents for closing.

Understanding the Role of HOAs

Homeowners’ associations, commonly referred to as HOAs, are responsible for maintaining communal areas within a neighborhood or condominium. This includes tasks like lawn maintenance, trash collection, and snow removal, among other responsibilities.

When a property within an HOA is purchased, the new homeowner automatically joins the HOA and is required to pay dues, also known as HOA fees.

During the final stages of a property sale, Escrow officers are tasked with obtaining the necessary HOA documents and fees. This is used to confirm that the seller is compliant with the HOA and to educate the buyer on the community’s rules and restrictions.

This task can be quite challenging for Escrow officers, given their numerous responsibilities during the closing phase. The process can be time-consuming, often requiring multiple follow-ups, and any errors in the documents or fees collected could potentially delay the closing.

How Can HOA Impact Your Closing?

HOA-related issues, including late or incorrect documents, can cause delays in closing. They can also induce additional stress and unhappy customers. There are three common challenges related to this process. These include :

Speed

HOAs, on average, take about 10 business days to provide the necessary information for closing. This, of course, can significantly vary from state to state. Any errors or back-and-forth communication can extend this timeline.

Additionally, the absence of a universal way of collecting information for HOAs further complicates the process. Not to forget, different HOAs in different states can have different types of documentation.

Client Experience

Dealing with HOAs during closing may take away from the quality of the client experience. The complexity of HOA requirements can increase confusion during the closing process. This, in turn, can lead to potential misunderstandings and frustration on the client’s end.

Therefore, it is essential to provide a smooth and stress-free closing process for clients. This can be achieved by automating the HOA document collection process.

Communication with HOAs

Taking care of the community requires a lot of effort and organization. The homeowners’ association needs to not only set rules and regulations but also ensure they are followed by the community members. To track and keep everything in order, the association has to document everything that is going on. However, since the management of an HOA is often voluntary work, things can get messy.

In many cases, Escrow officers face insurmountable difficulties and a lot of headaches trying to gather and organize information coming from an HOA. Starting with figuring out where to find the management of an HOA, through miscommunication in requesting documents, to receiving hand-written scanned documents that agents need to sift through– the work of getting HOA documents is ridden with difficulties.

Many local Title and Escrow companies maintain close communication with HOAs in their areas. Gathering HOA documents for such companies might not seem like such a hassle. Nonetheless, there’s no guarantee that knowing where to find the HOA management will equal getting those documents within the closing deadline.

Bigger companies operating in more than one state might face even more challenges, as they often are not as closely familiar with local HOAs. For these Title and Escrow companies, collecting and updating contact information over time might prove to be an overwhelmingly time-consuming task.

Outsourcing it to a third party altogether allows for smoother and faster access to the documents required for closing.

What HOA Documents Are Needed For Closing?

The documents required for closing may vary depending on the state’s laws and regulations. However, some of the most common HOA documents needed for closing include:

- HOA Estoppel Certificate

- HOA Governing Documents – Resale Package, Bylaws, CIC documents, CC&Rs, Financials, reserve studies, and more

- HOA Financial Records

- HOA Insurance Master Policy

Acquiring all necessary documents on time is essential for the smooth closing of the property. That being said, every Escrow officer understands that there is often a huge time gap between requesting the documents and getting all of them.

Nonetheless, there are certain steps you can take to improve the delivery time.

How Do You Improve the Collection of HOA Documents?

The first step to easing the process of HOA document acquisition is compiling a ready-to-go list that you can use for every closing. A few of the documents may differ for the different HOAs, but a comprehensive list should help you stay organized. Plus, it will save time in figuring out what documents are still missing.

As a next step, Escrow officers should set checklists that will help them ensure the validity of each of the documents they acquire. For example, making a note that the resale package information includes current dues, status of liens, or outstanding debts. These checklists help organize the process and ensure agents stick to the closing deadlines.

These two steps require a lot of organization and continuous supervision, which Title and Escrow professionals might not have at their disposal. This is where document automation might come in handy.

Is Automating HOA Document Acquisition Beneficial for Title and Escrow Companies?

Streamlining HOA document management can help Title and Escrow companies keep their highly-trained personnel fully engaged with the customers without distractions, thus improving customer satisfaction.

Automation can also help these businesses scale operations and manage multiple closings across states.

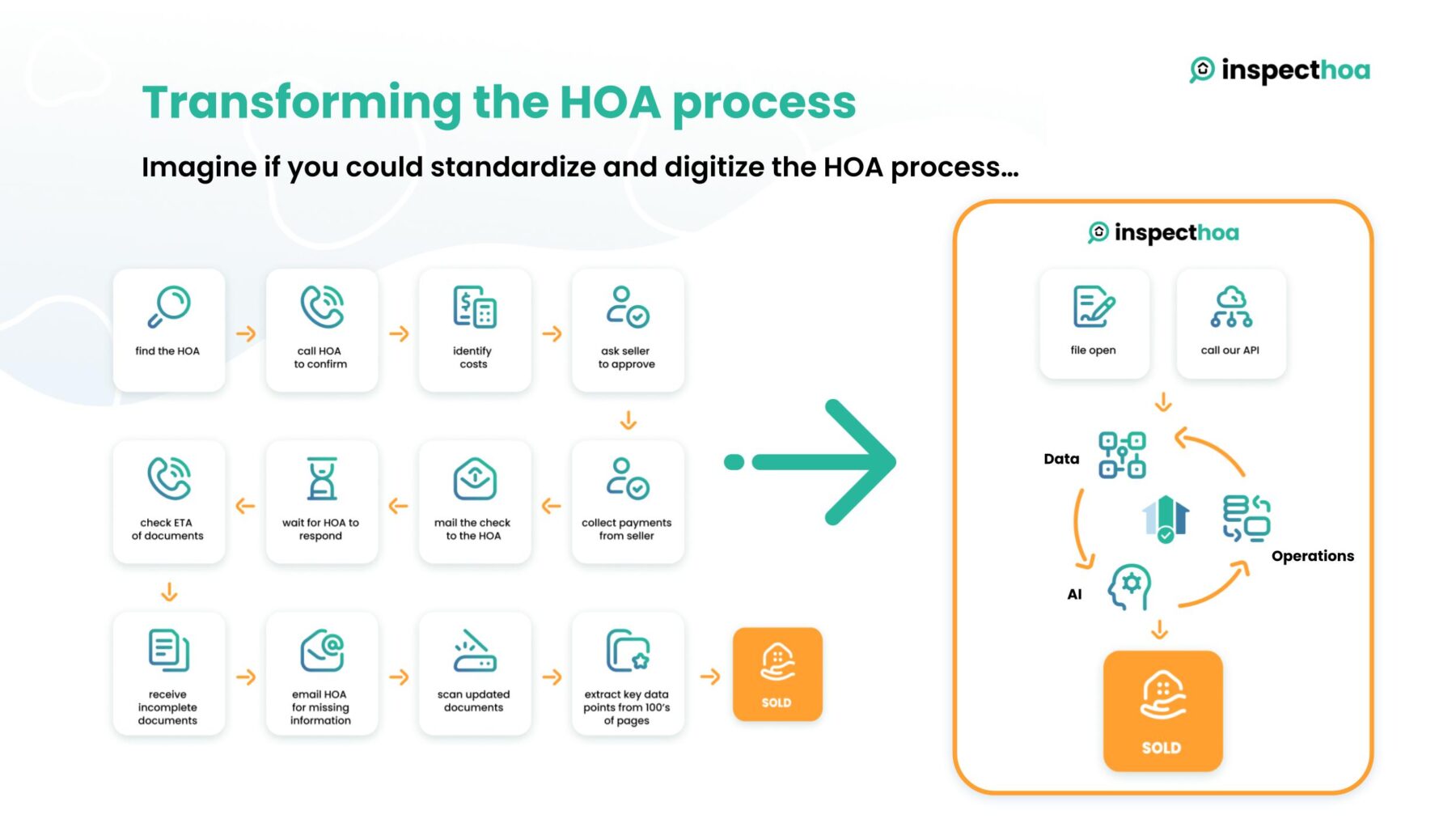

Furthermore, proptech solutions can assist in improving efficiency. They can significantly reduce the time it takes to request HOA documents and summarize the key insights with the use of technology like machine learning and AI.

Another benefit of automating HOA document acquisition is reducing the errors during document processing. You can compare the process to having multiple eyes on a document. Eyes that never get tired or miss a detail and are able to uncover and understand even more complex statements.

Streamlining HOA doc Acquisition with Rexera

HOAs can, at times, be hard to get hold of. Not only that, but sometimes a property has multiple HOAs, and contact information for them is missing. That issue would be resolved if there was a nationwide database of HOAs that held all the important information on each HOA.

And here’s where Rexera (formerly InspectHOA) can help. We’ve compiled the country’s most comprehensive and extensive HOA database that helps us streamline document acquisition for Title and Escrow officers. Combining the biggest HOA database with advanced technology and dedicated HOA experts allows us to break down the HOA document acquisition process into five steps:

- Identifying and contacting the HOA(s)

- Acquiring the HOA documents

- Analyzing all HOA documents

- Extracting the key HOA data points

- Summarizing and presenting them to you in an easy-to-read format

Those steps ensure that we help you speed up the acquisition process. Instead of spending, on average, 2 weeks on dealing with a single HOA, we take that burden off your shoulders and get the documents faster. Even if that means we physically knock on HOAs’ doors to get them.

Going further, our technology extracts all useful information from the HOA documents so you get a summarized analysis of the HOA’s rules and regulations, bylaws, and financials. All the while, we keep you updated on every step of the process so you remain in control of every transaction without the hassle of back and forth. For you, it’s only one step—submitting an order. From then on, we will take care of everything.

Summary

HOA documents can have a significant impact on property transactions. Failing to obtain all necessary documents can delay or even terminate the transaction.

Escrow officers should be invested in creating and maintaining an effective process when it comes to getting HOA documents. A challenge that often takes too much valuable time, jeopardizes due dates, and ruins client relationships.

But there’s an easy fix to all those issues, and that is automation. Data and technology help streamline tasks that do not require an individual approach. Roaming the internet for an HOA’s contact information is one such task. Instead, Escrow officers can take advantage of third-party vendors who specialize in HOA document acquisition. Proptech providers like Rexera (formerly InspectHOA) allow you to shift the focus back to where it truly matters— offering exceptional customer service.

If you’d like to take advantage of automating your HOA doc acquisition, you can always talk to our team, who will get you started on the hassle-free process.